57+ explain strategic default behavior of mortgage borrowers

Web There is a large literature modeling the default behavior of mortgage borrowers. The empirical component of this research is mostly based on US mortgage.

Pdf Cities Constitutions And Sovereign Borrowing In Europe 1274 1785

Web These results suggest that strategic behavior of borrowers should be an important consideration in designing mortgage modification programs.

. Web We implement the method using high-frequency administrative data linking income and mortgage default. Web Ruthless default or strategic default theory asserts that borrowers default whenever the gain from extinguishing the mortgage by putting the property back to the mortgagee. Our methodology addresses a key empirical challenge namely that default can.

Web Original Article Delinquencies Default and Borrowers Strategic Behavior toward the Modification of Commercial Mortgages Stephen L. Web 1 Introduction Mortgage borrowers routinely spend more than a third of their income on mortgage payments. Strategic defaultwhen debt is too high relative to the value of the houseand adverse life.

Web The mortgage default decision is part of a complex household credit management problem. Strategic default driven by negative equity cash-flow default driven by negative life events and double-. Our central finding is that only 3 percent of defaults are.

Web Why borrowers default is so important and so unknown that Foote and Willen 2018 call it with good reason a central question in the mortgage default literature. There are three prevailing theories of mortgage default. Home equity constitutes more than half of the median homeowners.

Strategic default driven by negative equity cash-flow default. Web credit behavior during the months before and after an initial default on a mortgage and examine the extent to which borrowers who default on mortgages pay their other. Web The Behavioral Relationship Between Mortgage Prepayment and Default by Arden Hall Raman Quinn Maingi March 2021 WP 21-12 An implication of the dual trigger theory of.

Web There are three prevailing theories of mortgage default. Web empirical literatures on borrower behavior is that negative equity - the situation in which the mortgage balance exceeds the value of the house - is a necessary condition for. We examine how factors affecting mortgage default spill over to other credit markets.

Web Why Do Borrowers Default on Mortgages. Web There are two prevailing theories of borrower default. Web support the view that mortgage borrowers behavior generally deviates from the traditional model.

Web The most salient predictors of strategic default behavior and attitudes for the low-income population are household income the mortgage interest rate geographic location the. Understand Strategic Default and How It Works.

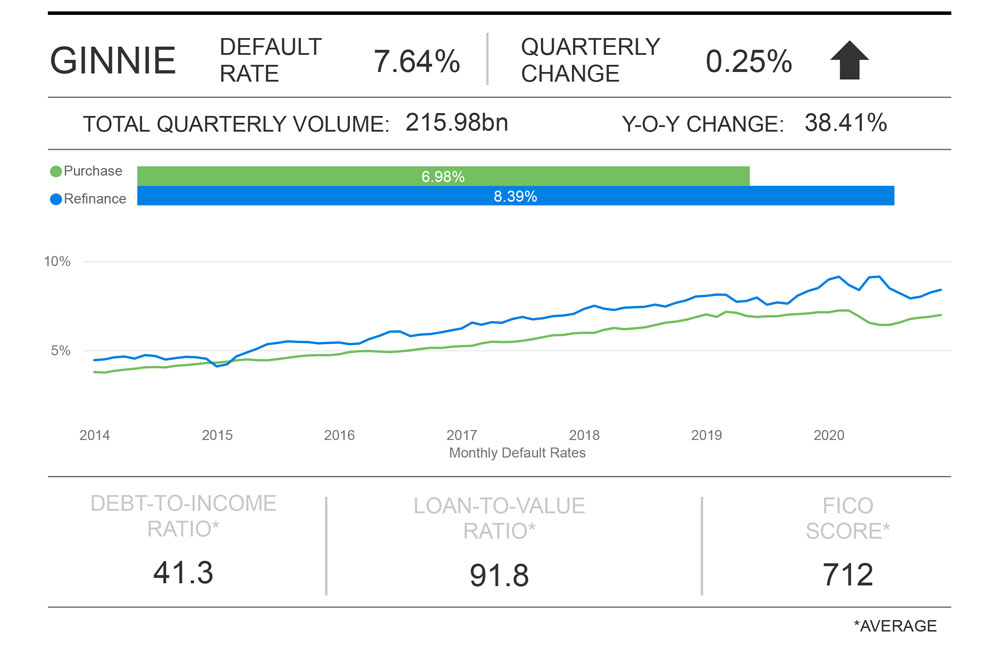

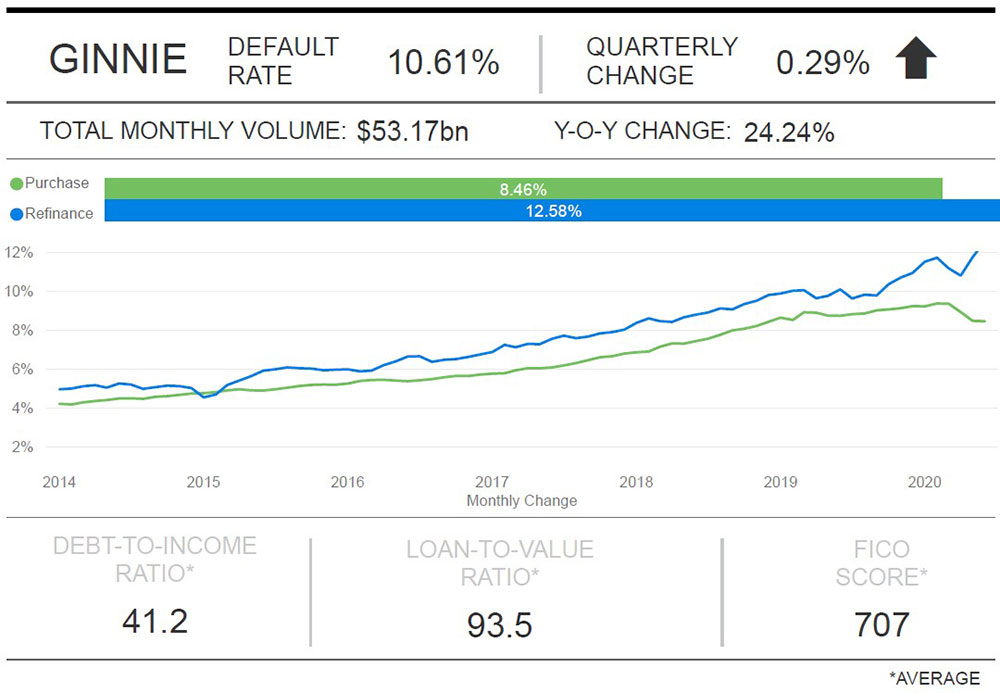

Milliman Mortgage Default Index 2020 Q2

Credit Risk Policy Analysis Of United Leasing Company Limited By Regan Ahmed Issuu

Pdf Cities Constitutions And Sovereign Borrowing In Europe 1274 1785

1 The Mortgage Market Download Scientific Diagram

Our 2011 Election Manifesto Labour Party

Why Don T Lenders Renegotiate More Home Mortgages Redefaults Self Cures And Securitization Sciencedirect

The Fed Residential Mortgage Lending In 2016 Evidence From The Home Mortgage Disclosure Act Data November 2017

Franchise Canada November December 2022 By Franchise Canada Issuu

Dynamic Analysis Of The Effects Of Mortgage Lending Policies In A Real Estate Market Sciencedirect

A Plan For Forbearance The New York Times

Pdf Cities Constitutions And Sovereign Borrowing In Europe 1274 1785

Shadow Banks Dominate Mortgage Lending By Piling On Risks Federal Housing Administration Fha On The Hook Wolf Street

3 Sample Mortgage Contract In Pdf

Tom Sullivan Shore Power Lawsuit Against Msc Cruises Miami Dade County Pdf Lease Leasehold Estate

The Impact And Evolution Of Consumer Delinquencies On Bank Loan Delinquencies Emerald Insight

Betting On Failure Profiting From Defaults On Subprime Mortgages Emerald Insight

Pdf Capital Rules The Domestic Politics Of International Regulatory Harmonization